Introduction: A Lifetime of Hard Work 🏗️

At the age of 12, John Smith began his journey into the workforce, long before many of his peers could even think about employment. His first job, earning less than $3 an hour, was a humble beginning in a country that promised hard work and dedication would lead to a comfortable retirement. Yet, despite decades of toil, the economic landscape has shifted dramatically, leaving people like John uncertain about their futures. 😟

The Financial Reality: Low Wages and Minimal Security 💸

Over his lifetime, John made approximately $300,000. He paid around $30,000 into Social Security, a system originally designed as a safety net for retirees. However, he never earned more than $15 an hour. Now, with the federal minimum wage pushing past that amount in many states, the financial gap between what he earned and what is now deemed a “livable” wage is widening. ⚖️ #CostOfLiving #WageGap

An Unforgiving Economy: Inflation and Rising Costs 📈

Today’s economy is a far cry from what it was when John first entered the workforce. Inflation, skyrocketing housing costs, and increasing healthcare expenses have erased the purchasing power of the dollar from earlier decades. While states raising the minimum wage to $15 an hour may seem like progress, even that wage struggles to keep up with the cost of living. For people like John, who never earned that much, the situation is even more bleak. Despite working consistently for decades, his Social Security benefits will likely be minimal, based on his earnings history. The end result is that John, like many others, faces the prospect of continuing to work well into his golden years. 😰 #RetirementCrisis #SeniorStruggles

Relocation: The Search for Affordable Living 🏘️

To avoid this fate, many retirees sell their homes elsewhere and move to cheaper places like Kingman, Arizona. 🏜️ Kingman used to be an affordable option, drawing retirees with its lower cost of living. However, as more people moved to the area, seeking relief from expensive cities, prices began to rise. Real estate values have increased quickly, making what was once a hidden gem more expensive for everyone. 🏠 #AffordableHousing #Relocation

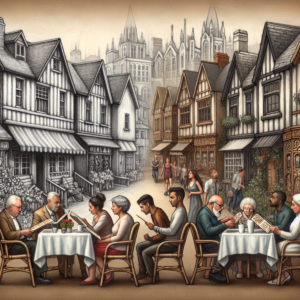

Gentrification: A Changing Kingman 🏛️

Adding to this is the gentrification of Kingman’s old town. As the area undergoes rebuilding and revitalization, the local community is being priced out of their own neighborhood. Older residents, who came to Kingman for its affordability, now find that even simple pleasures, like eating lunch in their own community, have become prohibitively expensive. The influx of new development has transformed what was once a small, quiet retirement community into a burgeoning town with rising costs. 💔 #Gentrification #PricedOut

Limited Services and Digital Divide: Barriers to Assistance 🚫

Despite the growth, the infrastructure of Kingman is still catching up. The town, historically filled with retirees, has fewer services available than larger cities. Healthcare, public transportation, and social services are not as robust as in more densely populated areas. 🏥 Compounding this issue is the digital divide: many of Kingman’s older residents have limited computer knowledge, which hinders their ability to access online resources that could help them navigate this new economic landscape. 💻❌ #DigitalDivide #LackOfServices

Conclusion: A Call for Action 🙏

John’s story reflects the struggles of countless Americans who have worked hard all their lives only to find that the promises made to them—of retirement security and financial stability—are harder and harder to keep. While places like Kingman once offered refuge, the rising costs and gentrification have put many retirees in a precarious position. 🤔

As the economy continues to evolve, it’s critical to consider the needs of those like John, who are being left behind in the rush toward progress. Addressing these challenges will require thoughtful solutions, such as expanding services for retirees in growing communities, bridging the digital divide, and ensuring that affordable housing remains available for those who have already worked a lifetime to earn their retirement. ✊ #SupportOurSeniors #AffordableLiving #RetirementSecurity